So this past week I did a brief interview (ok maybe not so brief, because I ramble, even when I’m typing out my answers) with another blog Debt Free Divas and I was talking about my absolutely INSANE mountain of student loan and medical debt (all and all around $90k) and how I haven’t really started to tackle the loans…yet… I was doing a little calculating on all the ways I coulda, shoulda and looking back woulda saved myself (and my parents) a whole shit ton of student loans…yeah…a whopping $60k give or take. So I figured, why not expand on some great ways that Future, Current and Parents of College students can avoid massive student loans! Take it from me and learn from my big fat $60k mistake…student loans are awful.

Now I can’t go back and change the past, as much as I would like there are definitely a few relationships that I would have pressed the skip button and a lot of stupid young 20 something mistakes that I made, but if I can look back and give someone else maybe a few tips and tricks to help them avoid making my mistakes I’m all for it.

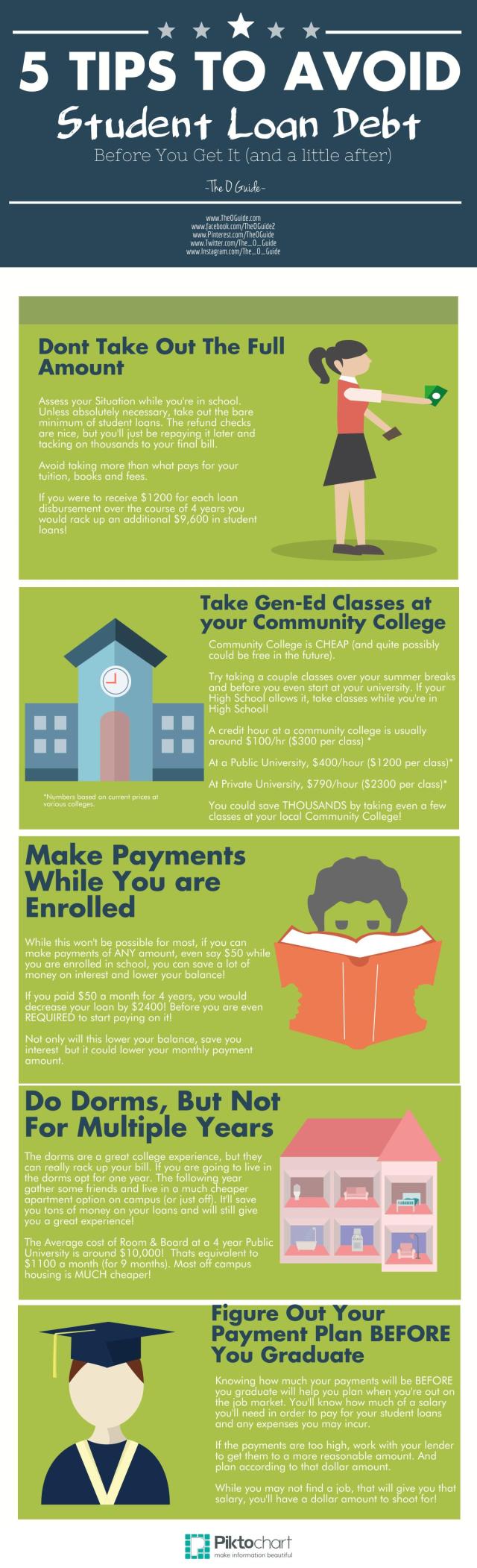

So here are my ____ Tips for Avoiding some student loan debt!

1. Don’t take out the full amount.

Oh.My.Gosh. Dont do it. Its soooo tempting. Its sooooo easy to do. Its sooooo nice to have a $1500 refund check after disbursements. But don’t do it! Just run away from taking the extra! There are obviously circumstances which may require you to…maybe you don’t live on campus and you’re in med school and you’ve gotta take out the full sha-bang to get through school since you can’t work. I’m not going to lie, those refund checks got me through some really rough patches financially…they paid my rent on more than one occasion. So let me break it down for you *note these are rough estimates based on what I vaguely remember getting…

I was in school for a total of 7 years, for two bachelors degrees. Each term I’d get a refund check for around $1200. If I would have NOT taken those extra loan dollars over the course of my education, I would have saved around $16,800 in student loans.

$16,800.

Yeah. $16,800. Plus at the end of it all (at say a 6% interest rate) an additional $1000 in interest.

I worked full time throughout my education. I had roommates for a few years and ended up finding that living alone was much better suited for me. While those refund checks did help me financially pay my bills there was a lot of times where I just spent them…on crap. Bought a new car, got a new computer, went on vacation. I relyed a little too much on the loans for survival, when I really could have figured out a better budget or tried to cut back in other areas and made it work in other ways.

You have to REALLY evaluate your needs and your situation when it comes to the refunds. There were times where they literally saved me from getting evicted, and got me out of a lot of tight spots.

2. Take Gen-Eds at a community college on your summer breaks or before you even start school (if you can).

Oh how I wish I did this. When I was in High School I finished all my required credits after my first semester of my senior year. I actually only had to take 2 classes that semester. I had a fun senior year, I took literally an entire day of art classes. It was super fun! But the school counselors had suggested I take some college courses at the local community college to get some out of the way. I didn’t listen…of course. I ended up going to my very expensive art school for ALL my classes. So lets break that down:

At my first school, credit hours currently are $790/hr. A semester of 12-16 credit hours runs around $11,000. (this just makes my stomach hurt by the way)

At the community college in my hometown, the credit hours are currently $108/hr. So for one semester of 12-16 credit hours would run around $1200.

I could have taken 2 classes each semester in High School, and at least 2 over the summer before I started school and for the summer I returned home. For a total of 8 classes. So 8 classes would have cost me around $3500…compared to $22,000. Thats a savings of $18,500!

So are you keeping track? Right now, if I would have done just those two things, I would have saved a total of $35,300 on student loans. And around $2000 in interest at a 6% interest rate.

3. Do Dorms, but only for one year.

So when I went to school the first time, I stayed in the dorms. The dorms are one of the things that I feel like are an AWESOME way to experience college. I definitely recommend it to anyone who can live in on campus housing. You will have a year filled with new friends, lots of memories and a blast. My biggest mistake? I went into the dorms for 2 years. Now my school was a little on the unusual side as it was a private school, and incredibly expensive. My room and board fees were $12,000 a year. The first year I didn’t have a meal plan because they had apartment style housing, the 2nd year I did which tacked on another $3000 in loans. So for two academic years (9 months not 12!) I spent a total of $27,000 on student housing. That equaled out to be around $1600 a month. Rent at the time in Chicago for a MASSIVE one bedroom right across the street from my theater building? $1200. (I know this because I moved into it mid 2nd semester of my sophomore year, yet still paid for the entire year of student housing).

Now I don’t regret this. Not one bit. Some of my greatest memories of college were from living in the dorms, both the first year and the 2nd year. But I could have easily skipped the 2nd year and saved $15,000 on loans. It wouldn’t have killed me to do so, most of my friends lived in the dorms anyways and I still would have lived right on campus (the beauty of attending school in a major metropolitan city).

Dorms are a BIG expense and one that you can avoid if you want to save some money. Both my sisters stayed at home or lived off campus, thats not an option for everyone especially if you go out of state for school.

4. Make payments before you even get out of school.

Another thing I shoulda coulda woulda. Obviously living in Chicago, its expensive. There were many times where I had to borrow cash for rent or to buy groceries. But I also didn’t give myself a budget at all and didn’t track my spending or figure out where I could cut costs at all. I most certainly could have been smarter about money back then now that I look back on it. So paying the student loan payments would not ever have been possible before I finished school. Shit, I can’t even pay the full amount now…but with a little creativity, budgeting and making it a priority. Even if I paid $50 a month towards my student loans WHILE I was in school (remember I was working) and even while they were deferred, in forebearance (current status) for the 12 years since I’ve moved to Chicago…I would have already paid off $7200. Just by paying $50 a month. I have a few smaller sized ones (around the $2500-$3000 range) and I look at that number now…I could have paid off two small loans by now. And saved about $400 in interest!

5. This one may be kind of obvious but come up with a realistic plan for repayment.

This is something I’m just now trying to figure out. The earlier you’re able to try to figure out how much you’ll need to pay each month the more you can prepare for it. I actually completed my exit counselling for the few classes that I took for my (attempted and abandoned) masters. According to the counseling, in order for me to pay my current monthly expenses AND the standard re-payment amount I would need to make at LEAST $141,500 a year. I honestly don’t know how they calculated that number….it seems excessivly high and completely unrealistic. Because I mean…shit….if I could find a job that paid me that much I could easily pay off my loans in 2 years flat by sticking to my current budget and throwing entire paychecks

towards my loans.

Now that I am on a budget and know exactly what my expenses are each month, it lets me calculate how much I really need to make to comfortably afford my regular expenses, a little cushion for safety and a full standard payment on my loans. And let me tell you something…it is definitely not my salary now, but its also not $141,500. Now that I know what I need in order to be extra comfortable, I can be on the hunt for a position that will pay closer to that and start working on some side hustles!

On a final note, this isn’t part of my 5 tips, but its something I’ve come to realize is just as important as paying your bills on time. You really need to make saving a part of your monthly expenses. Even if its $25 a month. Paying your bills is a big responsibility and a very important part of being a grown up. (being a grown up sucks…) but saving is what is going to give you a safety net if things go down the tubes. I used to really believe that I couldn’t “afford” to save. I was living so paycheck to paycheck that I couldn’t see beyond my present situation. But I should have tried to put away even just little pockets worth of cash here an there, where ever I could, whenever I could. It wasn’t until this past year that I really amped it up and made saving a priority. Now I treat it like a bill. And even when I start paying my student loans, my savings will still be a bill. And in the instance that a crisis occurs I’ll have a safety net to fall back on.